A stocktake on global wealth and the future of inequality

What the latest Global Wealth Report from UBS and Credit Suisse has to say about the state and future of wealth and inequality

After Credit Suisse’s dramatic bailout earlier this year, the first wealth report with new owners, UBS, was released this week. The report’s underlying data is the basis of some of Oxfam’s most famous killer stats, from this year’s infamous ‘richest 1% pocketing two-thirds of all new wealth’, to this picture of the ever-smaller types of transport sufficient to fit the number of billionaires who own the same wealth as half the world (when will we reach a spaceship?).

In January, Oxfam will release its annual inequality report to coincide with Davos, the meeting of the rich and powerful in the Swiss ski resort, with an in-depth analysis of the latest data on wealth inequality. This week, we’re taking the opportunity to see what the UBS/Credit Suisse report says about global wealth and what this means for inequality.

Global Wealth Report in numbers

Fall in household wealth? The huge weight of state financial support released by wealthy countries during the pandemic saw company shares and house prices soar, setting records for the rise in household wealth. This was most keenly enjoyed by those at the top with the pandemic creating a new billionaire every 30 hours. Last year household wealth fell off a cliff, with $11.3 trillion, or 2.4%, lost – the second-largest decrease this century. However – and it’s a big however – currency depreciation against the US dollar played a significant role in this fall. If exchange rates had remained constant at 2021 rates, then total wealth would actually have increased by 3.4%. On the other hand, falling property prices (most wealth held by the bottom 90% is in property) occurred in the second half of 2022 so the full extent of the drop may not yet be taken into account.

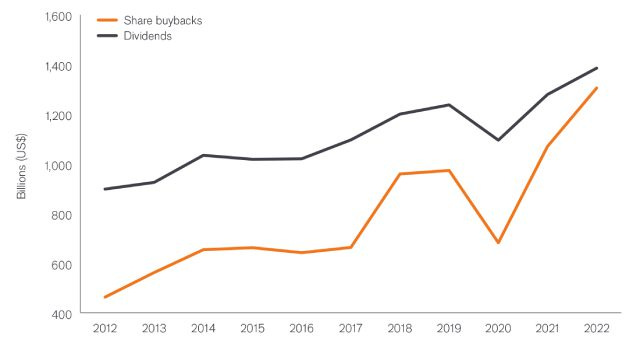

Fall in financial assets. A slump in share prices was the most significant contributor to the decline in global wealth and so unsurprisingly wealth loss was most acutely felt in North America and Europe. The UBS report finds that the share of global wealth held by the 1% (millionaires) returned to 2019 levels after its spike during the pandemic. This tallies with a slight 3.9% decline in the wealth of billionaires in 2022. This might surprise you, given the ability of the rich to prosper from economic shock, but don’t shed a tear – by the end of 2022, billionaires were still about 23% (in real terms) richer than they were before the pandemic. Income and wealth are inextricably linked for the richest, who derive much of their income from financial assets, and while share prices have been falling, the cash paid out to shareholders in dividends and share buybacks has soared to record levels.

(Source: Janus Henderson)

Wealth of women. The 2019 Credit Suisse report had important research about the wealth held by women around the world, which led to Oxfam finding that the “world's 22 richest men are wealthier than all the women in Africa”. In some places, women own as little as 25% of the region’s wealth. Women tend to hold more non-financial assets and less in corporate shares and so the gender wealth share probably fell in 2021, as financial assets soared. The UBS report predicts that gender wealth inequality has likely now reversed back to pre-pandemic levels.

What this means for inequality. While the wealth share of the dollar millionaires fell slightly in 2022 compared to 2021, it is still higher than before the pandemic. Getting a picture of what is happening to the world’s poorest is fairly absent from the UBS wealth report, so you’ll have to wait until Oxfam’s report in January for a deep dive into the data behind the UBS report.

However, at the risk of stating the blindingly obvious, since the pandemic, wealth inequality has risen. The richest saw their financial assets soar thanks to state intervention. The poorest, especially in countries with limited fiscal firepower, had to draw on savings and take out loans and so there is an inevitable decline in their wealth - the cost of living crisis will have compounded this even further.

Staring into the crystal ball. UBS predict a 38% rise in global wealth by 2027 with over half of that coming from low- and middle-income countries. They forecast the number of millionaires will reach 86 million and multimillionaires to 372k while the number of people with wealth below $10k will fall from 53% in 2022 to 47% in 2027. It will be interesting to dive into the data to see how the changes at the top and the bottom will impact inequality measures such as the Palma.

You can read the Global Wealth Report 2023 in all its glory here.

Scope for hope

Bringing this Bulletin full circle, at this year’s January Davos meeting, Colombian Finance Minister Jose Antonio Ocampo announced plans for a tax summit for Latin America on global tax rules. This has now happened and at the end of July, 16 countries from Latin America and the Caribbean came together to create a tax cooperation platform that could be a game changer for progressive taxation in the region. We’re excited to see what will come next but if action matches the rhetoric we could be witnessing an entire region rejecting a global tax system that favours large corporations and the wealthy.

Win for vaccine transparency. The Health Justice Initiative (HJI), a member of the People’s Vaccine Alliance, has won a court case in South Africa that will compel the National Department of Health to release the contracts with pharmaceutical companies for Covid-19 vaccines. This will be a massive step forward in terms of transparency and will lift the veil of secrecy surrounding vaccine deals during the pandemic. A huge win, congratulations HJI for your tireless campaigning on this issue.

Something to read

There’s a strange space where the left and right of the political spectrum meet. The “new right” has been berating corporations for their wokeness while the left has an innate scepticism for corporations seemingly doing ‘good’ as a guise for making more profits for wealthy shareholders. Read this review of four books by the Economist about how the “reactionary right and Luddite left have converged”. Fascinating.