How corporations fuel inequality (and why it doesn’t have to be this way)

Putting shareholders first lines the pockets of the 1% but there is a better business model.

Record profits by large corporations amidst a cost-of-living crisis have sparked accusations of greedflation. The idea is that companies are using the war and the pandemic as a smokescreen to bump up their profits and margins, in doing so they are fuelling inflation. At the same time, wages are failing to keep up with inflation. Growing inequality is the only likely outcome of these trends.

In this week’s Equals Bulletin, we’re looking at how the corporate model of maximising profits for shareholders is increasing inequality and what an alternative private sector might look like.

Cartoon by Luc Vernimmen licenced from the Cartoon Movement.

Corporate inequality in numbers

Record shareholder payouts. Global dividends to shareholders reached a record $1.56 trillion in 2022, an 8.4% increase. 88% of companies increased their dividends but it was oil, gas and financial companies that accounted for half the growth.

Hardly surprising. This week, the European Central Bank announced that it is monitoring companies for potential price gouging amidst evidence that increasing profit margins, not wages, are driving inflation. Over half of inflation in the euro area during Q4 2022 was because of profits. Think tank Common Wealth found that UK supermarket profits and dividends are soaring amidst 18% food inflation in the country.

Where’s that cash going? Don’t believe the line that more cash for shareholders is good for the average person’s pensions and savings. In South Africa, the wealthiest 1% own more than 95% of bonds and corporate shares, with the richest 0.01% owning 62.7%; in the US, the richest 1% own 54% of the shares held by US households; and in the UK, the wealthiest 10% own 46% of all pension wealth, while the poorest 10% own less than 1%. The state’s cut is falling as well, the tax rate on dividends in OECD countries dropped from 60.8% in 1980 to 41.7% recently.

It's pretty safe to say most people would be better off if dividend cash was used to increase wages and fund social services instead.

What would happen to inequality if dividends were used on better things? Walmart, one of the US’s largest employers paid $16bn to shareholders (around half of which went to a billionaire family), enough to give every employee an almost $10k pay rise. Just one-third of shareholder payments by top fashion companies would be enough to lift all 2.5 million Vietnamese garment workers to a living wage. The dividends paid out by the oil and gas industry could have increased global investments in renewable energy by nearly one-third.

Don’t loads of companies do this already? Most corporations are structured to put shareholder interests first – but there’s a whole side of the economy that put people and the planet first by design – reinvesting profit into their mission rather than paying shareholders. By some estimates, social enterprises and co-operatives contribute as much as 10% of the US and Europe’s GDP. Co-operatives generate far more employment than every multinational combined.

Fairer by design. In the UK 74% of social enterprises pay a living wage and 52% of CEOs from World Fair Trade Organisation members are women - in the UK’s FTSE 100 you’re more likely to be called Dave or Steve than be a female CEO (7%). One study found that Britain’s top five co-operatives pay more tax than Amazon, Facebook, Apple, Ebay and Starbucks combined.

Preventing inequality in the first place. Most fixes to inequality centre on re-distribution via tax. However, worker and community-owned organisations offer a glimpse of what a more equal market-based economy could look like. Mondragon is the world’s largest worker cooperative and the area they are based, Gipuzkoa in Spain, has a lower Gini coefficient than Finland and Norway – one engineer at the company put it like this:

“The objective of the cooperative is not to produce rich people, it’s to produce rich societies”.

What does a private sector that prevents rather than creates inequality look like? Comment below.

Some hope

Ditching patents. Treatment for tuberculosis could become much cheaper for people in India after Johnson & Johnson’s application to extend a patent was rejected. Treatment could be cut from $47 to $8 a month thanks to Nandita Venkatesan from India and Phumeza Tisle from South Africa’s fight to make the drug affordable for all. Hopefully, many more victories to come.

Some things to read/listen/watch

Watch Jon Stewart’s brilliant interview with economist Larry Summers where the double standards of blaming workers for inflation are laid bare.

Read about how reducing inequality could cause a huge fall in world population.

Read a great analysis of the roots of the French protests and watch Melenchon, leader of the French Left speak eloquently on the fight to work less and save the planet

Listen to this Freakonomics podcast about an experiment where taxpayers decide how the money is spent.

Read about groundswell support in New York to tax the rich.

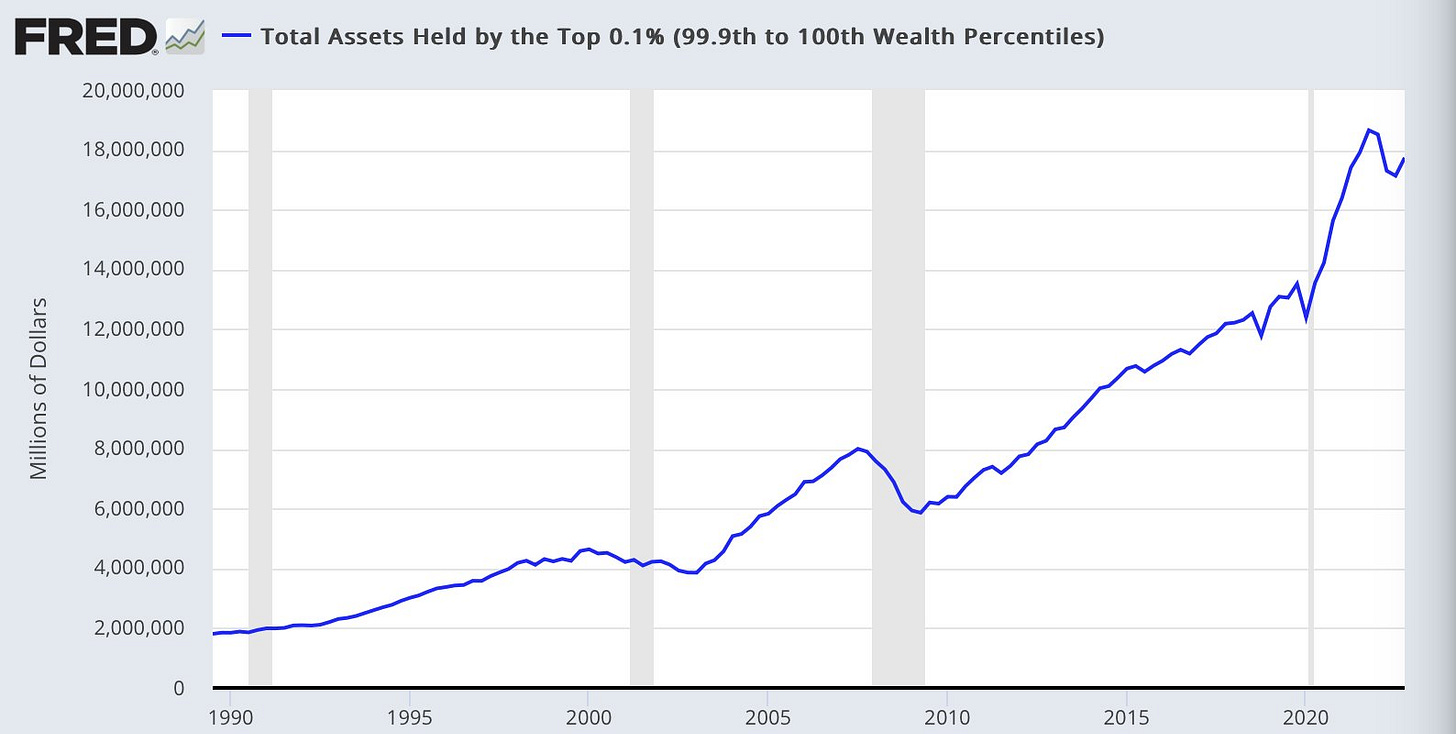

Chart of the week

(h/t @NorthmanTrader)