"Inequality Inc." Part 3 – How corporations fuel inequality

The consequences of putting shareholders first.

Over the last two weeks, this “Inequality Inc.” series has looked at how we’re in the midst of a decade of division with corporate concentration driving inequality.

From squeezing workers while rewarding the wealthy, to dodging tax, privatizing the state, and spurring climate breakdown ―this week we’re looking at how powerful corporations are driving inequality.

Corporate inequality in numbers

Rewarding the wealthy, not workers. Since the mid-1990s real wage growth has fallen behind productivity growth in two-thirds of OECD countries ―workers are producing more and getting paid less. By 2022 the gap was its widest since the beginning of the 21st century. The cost-of-living crisis has worsened trends, between 2021 and 2023 wages in 52 countries had fallen so far behind inflation that people have worked the equivalent of a month unpaid.

Policies undermining workers. Of more than 1,600 of the largest and most influential corporations worldwide, a mere 0.4% of corporations are publicly committed to paying their workers a living wage and support a living wage in their value chains. 0.7% of these corporations meet a global bar for collective bargaining. Trade unions and collective bargaining are a proven route to increased wages and lower inequality. In OECD countries, union membership has fallen from 30% in 1985 to 17% in 2017.

Lining the pockets of the wealthy. As we showed in Part 1, since 2021, some of the largest corporations are making huge windfall profits. Most of these windfall profits are going to shareholders. We found 82% of profits from major corporations were paid out in dividends and buybacks. If all the global shareholder payouts to the richest 10% instead went to the bottom 40%, global income inequality, as measured by the Palma ratio, could decrease by 21.5% ―equivalent to the actual drop in the Palma ratio observed over 41 years.

Systematic exploitation of women. In 2019, the latest global data available, women earned just 51 cents for every $1 in labour income earned by men. Women also suffered harsher economic impacts from the pandemic and collectively lost $800 billion in earnings in 2020. Gender inequality is exacerbated by supply chain strategies that undervalue much of the work done by women. Of the major global corporations, only 24% have a public commitment to gender equality and just 2.6% of corporations disclose information on the ratio of pay of women to men. Women and girls effectively subsidise the economy by doing more than three-quarters of the unpaid care work worldwide. The monetary value of unpaid care work carried out by women globally is at least $10.8 trillion annually (although can this really be captured in monetary terms?).

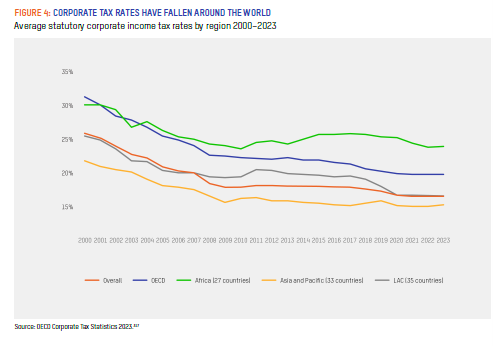

Dodging taxes. Since 1980, the statutory corporate income tax rate has more than halved in OECD countries and globally corporate income tax rates fell in 111 out of 141 countries between 2020 and 2023. Globally, the actual corporate tax rate dropped from 23% to 17% between 1975 and 2019. An estimated $1 trillion in profits – 35% of foreign profits – were shifted to tax havens in 2022, depriving societies of resources to address inequality. Corporate lobbying on tax is highly effective, in the US, 1% extra spent on lobbying was found to have reduced companies’ effective tax rates by 0.5–1.6% on average and every $1 spent on lobbying related to a tax holiday had a return of over US$220. Essentially another tax cut for the rich.

Privatisation. Public services are generating massive wealth for billionaire owners. In India alone, four billionaires are invested in the private hospital and diagnostic sector. The global water and sewage market is estimated to reach US$886bn in 2027. Analysis of 51 companies receiving public contracts in the USA found that these companies spent nearly US$160bn on stock buybacks between 2020 and 2023, meaning taxpayer money was in effect lining the pockets of rich shareholders. Privatisation can segregate access to services; for example despite parity in Tunisia’s public schools, the share of girls in private schools drops to 30%.

Driving climate breakdown. Despite all the greenwashing, investments in low-carbon businesses represent less than 1% of oil and gas companies’ capital expenditure. Fossil fuel and mining companies have sued governments for plans to limit fossil fuel phaseout and won over $100bn. Most of these cases are corporations from rich countries suing the governments in poor countries.

Read chapter 3 of the report Inequality Inc for all the details and our methodology note to learn have we crunched these numbers.

Something to read and listen to

Listen to the Sick Development podcast, a miniseries about a collection of private hospitals in the Global South are systematically abusing patients and denying healthcare, causing hardship, suffering and death. And they are using your taxes to do it.

Listen to this Taxcast episode about a century of tax rule setting by the former imperial powers has been overturned with the UN vote on global tax reform.

Watch this DW documentary about the influence of the super-rich in Germany.

Read this Novara Media piece on how Bernard Arnault built his fortune.

Watch what people thought of our figures in these street interviews.