They say death and taxes are life’s only certainties, but many of the super-rich are trying to dodge both. Billionaires like Bezos are pumping their fortunes into anti-aging start-ups while paying less than 1% effective tax. On the other hand, Aber Christine, a market trader in in Uganda, who makes about $80 a month, pays 40% tax.

At Davos last week we had one key message - Tax The Super Rich. That this is any way a controversial message speaks volumes to the power of the neo-liberal comms machine.

In this week’s edition, Equal’s Bulletin goes into the numbers behind our tax proposals.

Taxing the rich in numbers

First, some context. Over the next five years, three-quarters of governments are planning to cut spending, with total cuts of $7.8 trillion. Governments are feeling the squeeze but are turning to public spending cuts, not tax rises. At the same time, since the start of 2023, the wealth of the world’s 2.5k billionaires has been increasing by almost $1bn an hour.

#TaxTheRich, not new, not radical. For large parts of the 20th Century, it was normal to tax the incomes of the richest at 60% or above. In the US for example, top federal income taxes stood at 91% in the 1950’s. Top inheritance tax rate was 77% until 1975, and corporate tax averaged just over 50% during the 1950s and 1960s. These taxes on the wealthiest went hand in hand with successful economic development.

Governments have successfully taxed wealth, inheritance, property and other forms of wealth, and lived to tell the tale. Mind blown.

Sliding in the wrong direction. In Latin America, marginal tax rates on the highest incomes fell from 51% in the early 1980s to 27% by 2015. In Africa, they have fallen from 38% to 31% over the last 25 years. And in the last 30 years the number of countries with a net wealth tax fell from 12 to just 4.

Guess who’s picking up the slack? In the same 30 years the number of countries implementing VAT – a tax that penalises the poorest, women, and racialized groups – has soared. The same people who are hit hardest by unnecessary and immoral austerity measures.

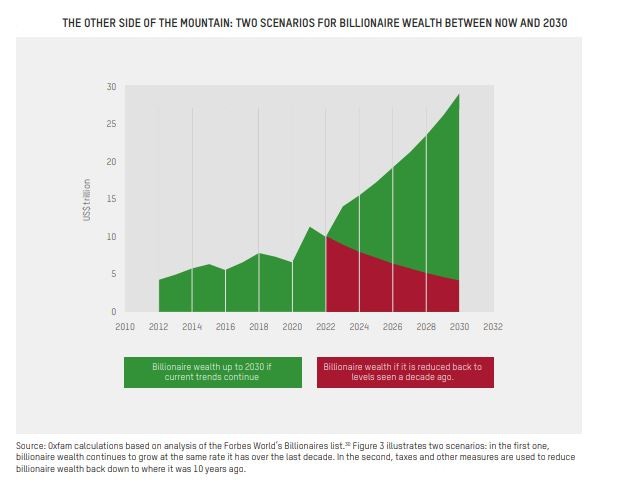

While the super-rich get away with it. Elon Musk is one of the richest people ever, but he pays a true tax rate of just over 3%. Jeff Bezos, head of Amazon’s low-wage empire, pays less than 1%. And today half of the world’s billionaires can pass on their wealth without facing any inheritance tax. Without an end to this low-tax regime for the richest, the inequality mountain will keep growing

Show us the money. An annual wealth tax of up to 5 percent on multi-millionaires and billionaires could raise $1.7 trillion a year. That’s enough to lift 2 billion people out of poverty and fund a global plan to end hunger.

Some hope

People won’t accept inaction much longer. 85% of Brazilians are in favour of increasing taxes on the super-rich to finance essential services, and 69% of people polled across 34 African countries agree it is fair to tax rich people more than everyone else to fun ‘government programs to benefit the poor’.

Some rich people even agree. Over 200 millionaires signed a letter calling for higher taxes.

And governments are stepping up. 2022 has seen progressive reforms and proposals in Colombia and Chile, including net wealth taxes, and there’s change in the air across Latin America. Higher taxes on the richest are also on the table in Kenya, Canada, the Netherlands and Malaysia. And the IMF advised Sri Lanka consider them to avoid looming debt disaster.

Some things to read and watch

Read this incredible investigation into how big pharma and the German government attempted to silence the People’s Vaccine Alliance’s campaign to lift IP on Covid-19 vaccines.

Watch Columbia’s minister of finance José Antonio Ocampo at Davos announce the first tax summit in LAC, a key moment for tax justice as OECD's power is challenged by developing countries. This will be a huge opportunity for a collective push for wealth taxation both in the region and beyond.

Listen to Oxfam’s twitter space on the Survival of the Richest report