New analysis: corporations make $1 trillion a year in windfall profits

Huge profits are creating a greedflation effect as the cost-of-living crisis persists and workers face real wage cuts globally.

Calls for ‘wage restraint’ from top policymakers come as Oxfam’s analysis of the world’s largest corporation found an 89% jump in total profits while workers across 50 countries took a 3% real-term wage cut. Pinning economic woes on the workforce is the oldest neoliberal trick in the book but their position is becoming increasingly indefensible.

In this week’s Equals Bulletin, we look at the numbers behind the eyewatering windfall profits using the latest data.

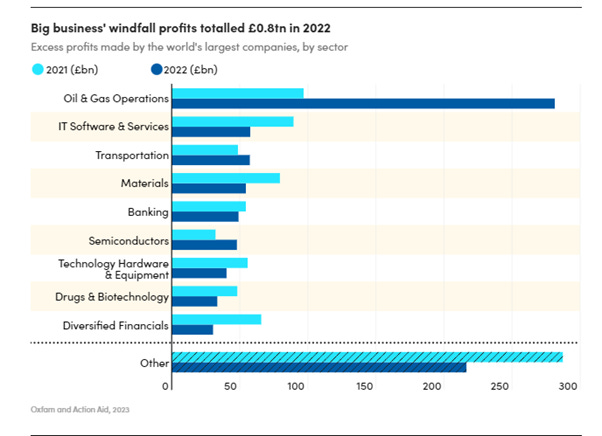

Top line about the bottom line. 722 of the world’s biggest corporations together raked in over $1 trillion in windfall profits each year for the past two years, amid soaring prices and interest rates. Windfall profits are defined here as when the 2021-2022 average profit is 10% and above the 2017-2020 average. Amazingly their total profits saw an 89% jump.

Graphic by Raconteur

Which companies are these? The research started with the Forbes 2000 list, which ranks the world’s largest public companies. Through a process of elimination, removing companies that weren’t on the list every year since 2017 and companies which didn’t make a profit in the last two years brought the number of companies down to 976. Of those companies, 722 (74%) made a windfall profit. The methodology note for the research is here.

What sort of companies? These companies dominate the global economy and include the biggest energy, food, defence, drugs and retail corporations in the world. The analysis found that:

45 energy corporations made on average $237 billion a year in windfall profits in 2021 and 2022.

18 food and beverage corporations made on average about $14 billion a year in windfall profits in 2021 and 2022 and 42 major retailers and supermarkets made on average $28 billion a year in windfall profits. Global food prices rose more than 14% in 2022.

28 pharmaceutical corporations made on average $47 billion a year in windfall profits and 9 aerospace and defence corporations raked in on average $8 billion a year in windfall profits.

So, is there evidence of greedflation? Certainly higher corporate profit margins are contributing to inflation, the OECD Economic Outlook makes that plain. The argument neoliberal economists are putting forward is that this is simply inevitable – as The Economist puts it “the alternative to letting the price mechanism bring supply and demand into line is to rely on something worse, such as rationing or queues.” But the price mechanism simply becomes rationing for the rich, ensuring that only those who can afford it are the ones that get to the front of the queue; meanwhile, bumper profits are guaranteed.

Can we claw back these windfall profits? A tax of 50 to 90% on the windfall profits of 722 mega-corporations could generate between $523 billion and $941 billion for each of the last two years. How could that be spent? Loss and damage finance for climate change is urgent, with low- and middle-income countries facing costs of up to $580 billion annually by 2030. The finance gap for universal social protection and healthcare in low- and lower-middle-income countries is $440 billion.

There’s no lack of transformative ways that this revenue could be spent, but it’ll take governments standing up to corporate greed.

Share your thoughts about greedflation in the comments below.

Scope for hope

A long campaign aiming to give low- and middle-income countries access to the tuberculosis drug Bedaquiline on a generic basis has succeeded. This will bring the price of the drug down massively giving hope to millions of patients.

Something to read

The Rich Are Crazier Than You and Me – Paul Krugman in the NYT shows how billionaires getting sucked down the conspiracy rabbit hole have enough money to do some serious damage.

Check out this brilliant newsletter from our friends at Inequality.org.

For the data geeks, this microsite on progress (or lack of) on SDGs.