Revealed: Crippling debt repayments and public spending cuts in the world’s poorest countries

New analysis from Oxfam at the World Bank and International Monetary Fund Annual Meetings in Marrakech lays bare the scale of the debt burden and cuts low and middle income countries face.

The World Bank and IMF annual meetings took place last week in Morocco amidst continuous high inflation and soaring public debt, contributing to the sharpest increase in global inequality since World War 2.

The institutions returned to Africa for the first time in decades with the same old message of prioritising debt repayments and austerity, while failing to talk about taxing the rich. This week’s Bulletin looks at the numbers behind the meeting.

Debt, austerity and wealth in numbers

Crushing debt. Low and middle-income countries have $12.3 trillion in public debt and will be forced to pay nearly half a billion dollars every day in interest and debt repayments between now and 2029. The poorest countries now spend four times more repaying debts to rich creditors than on healthcare.

Endless austerity. 57% of the world’s poorest countries, home to 2.4 billion people, are having to cut public spending by a combined $229 billion over the next five years. The IMF claims to mitigate the worst effects of its austerity-driven loan programs through ‘social spending floors’ that ring-fence government spending on public services. However, for every $1 the IMF encouraged low- and middle-income governments to spend on public services, it has told them to cut six times more than that through austerity measures. These floors are merely a smokescreen for more austerity.

While the rich are thriving. The latest report into inequality in the Middle East and North Africa has found that the richest 0.05% saw their wealth surge by 75% from $1.7 trillion in 2019 to nearly $3 trillion by the end of 2022. The region’s 23 billionaires have accumulated more wealth in the last three years than in the entire decade that preceded them.

Wealth tax not spending cuts. A 5% wealth tax on fortunes over $5 million would allow Egypt to double its spending on healthcare, Jordan to double its education budget and Lebanon to increase its spending on both healthcare and education seven times over. Morocco alone could raise $1.22 billion at a time when it is facing an $11.7 billion repair bill from the recent devastating earthquake there.

Oxfam’s press release with all these figures and methodology can be found here.

Scope for hope

A new measure for inequality. Regular Equals Bulletin readers will know that in July, 200 leading economists called for the UN and World Bank to implement new targets to tackle inequality. The World Bank has listened, at the meeting last week a new indicator was proposed on inequality, against which the Bank's work will be measured. It is one of five core indicators in the Corporate Scorecard and will measure how many nations globally fall into the category of having high inequality, as measured by the Gini coefficient, and aim to reduce this number over time. It remains to be seen whether this new indicator will be strong enough, and if it will, in turn, become the new indicator for SDG 10, replacing the very weak indicator that currently is used.

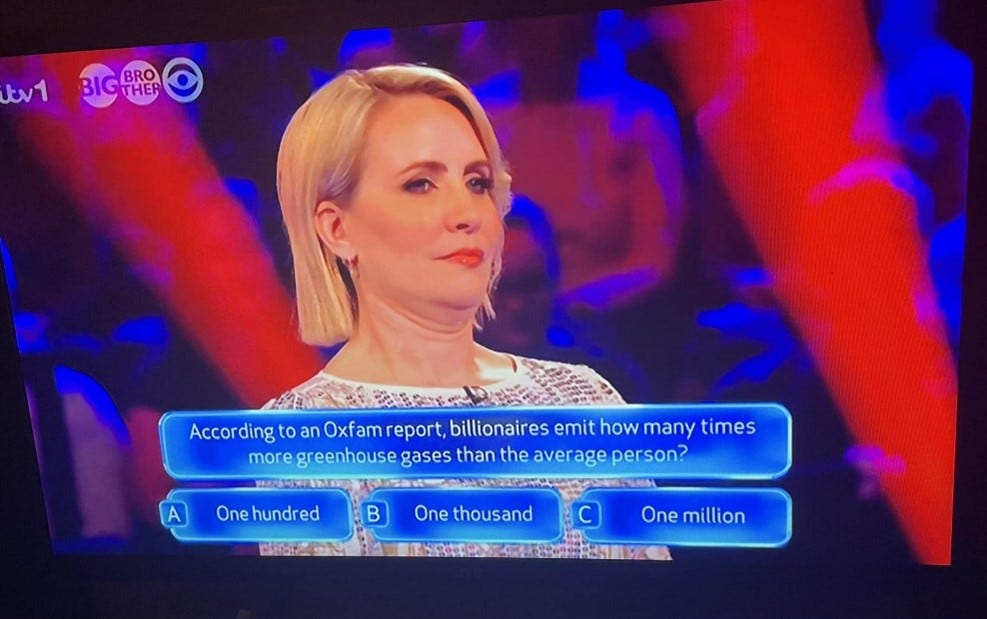

Carbon inequality is going mainstream. For the brits out there, you may have spotted an Oxfam stat was a question on the primetime quiz show ‘The Chase’. For the 90s pop fans out there, yes that is Claire from Steps.

(the answer is, of course, one million)

Something to read and watch

Watch the LSE’s seminar on how the World Bank and UN should strengthen inequality measures with Professors Francisco H G Ferreira, Jayati Ghosh and José Gabriel Palma

Read Alex Kentekelenis & Thomas Stubbs' excellent new book "A Thousand Cuts" which includes important findings on the IMF's effect on income inequality. Using clever econometric analysis, it shows conclusively that the IMF's claims to be helping countries reduce inequality are bogus.

Read ActionAid’s new report on The International Monetary Fund, Debt and Austerity in Africa.

Read this joint briefing which puts in stark terms the global debt crisis. The research found that current debt relief deals are leaving countries paying half their budgets on debt service.