Booming billionaire bounty

Amid the cost-of-living crisis, rocketing housing prices, wars and rising hunger, it’s been a bonanza for billionaires.

It is that time of year when Forbes publishes its annual list of the world's wealthiest people, the dollar billionaires, aka the pollutocrats, aka the vampires of capitalism. Sorry, Howard Schultz, we mean “people of means”.

The world's wealthiest people had a year like no other ―the number of billionaires and the scale of their wealth has shattered all previous records. In this week’s Bulletin, we dive into the rich list and crunch some new numbers to put that wealth into perspective.

Billionaire bonanza in numbers

Adding it all up. The world's 2,781 billionaires are now worth a staggering $14.2 trillion. How can we comprehend such a vast figure? It’s the combined GDP of 150 countries and not far off the $15 trillion held by every adult in Latin America combined. If these billionaires stacked their wealth in dollar bills, they’d get to the moon and back ―twice! Turns out they don’t need those spaceships after all.

Ballooning wealth. This increase is a staggering jump: billionaires are about $2 trillion richer than last year and $1.1 trillion richer compared to the previous record set in 2021. Since 2005, in nominal terms, billionaire wealth increased by 545%. The Forbes graph below shows the meteoric rise of their fortunes.

Off the Charts

Joining the ranks. Taylor Swift wasn’t the only person to join the club. 140 billionaires were added to the list, bringing the total to 2,781. This broke the already astonishing 2021 record by 26 people. We’ll put their medals in the post.

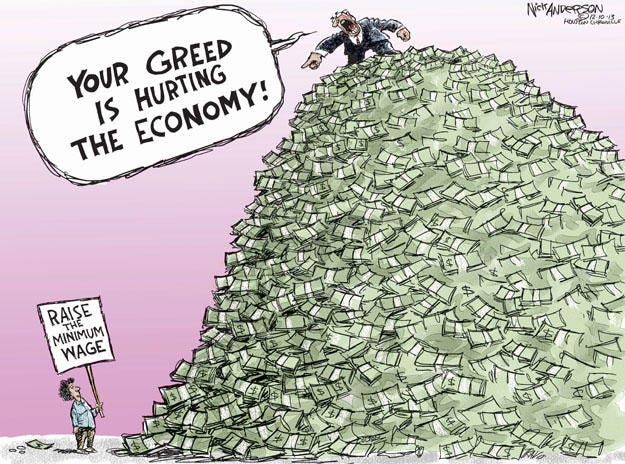

This stark contrast between their growing wealth and the average person's financial situation is a clear indicator of the growing inequality gap.

Booming across the board. We know what you’re thinking ―it’s probably just a few men at the top behind such a big gain. The wealthiest ten billionaires did indeed add about $422 billion between them in just a year, about a fifth of the total new billionaire wealth. Mark Zuckerberg saw his wealth rise by $112.6 billion, a staggering 170% growth. Jeff Bezos’ wealth grew by $80 billion, or 70%. But it’s not just those at the top, across the board two-thirds of billionaires saw wealth gains.

This funnel graph shows how the wealth of billionaires is concentrated amongst the very top. Does the champaign glass look familiar?

Tracking them down. The United States, by far, accounts for the biggest share of billionaire population and wealth. The combined wealth of US billionaires is $5.7 trillion, or 40% of total billionaire wealth, and their population stands at 813. If they were a country, it would be the third richest country in the world in terms of GDP. China is the closest country that rivals the US, which accounts for 9.4% of billionaire wealth.

Millenialares. Every billionaire under 30 inherited their wealth. As The Guardian reports, it’s part of “The Great Wealth Transfer” where 1,000 young people are about to become stinking rich as they inherit $5.2 trillion. With half of the world’s billionaires living in countries with no inheritance tax for direct descendants, there’s no end in sight for the ever-concentrating wealth at the top.

Final thought, profiting from chaos. The upheavals the world witnessed last year were a blessing to the ten-figure club, as inflation jitters and rising interest rates failed to calm the bullish stock markets. While the aggressive increase in interest rates by central banks has devastated households’ incomes and increased public debts, the wealthiest people have been unscathed, if not benefited.

That said there are glimmers of hope. As we recently reported, under Brazil’s leadership, the G20 are beginning to get serious about taxing the rich and a European Citizen’s Initiative is fast gaining momentum.

Something to read/listen to

Listen to this episode of Ones&Tooze about the long shadow cast by Covid-19. The human cost of the inequality virus, with a bit of distance, is truly powerful and shocking and most dramatic in education.

Attend this online World Bank event (8th April) on why tackling inequality is essential for growth in Africa.

Read Ingrid Robeyns’s new book on how much is enough.