In the last Bulletin, we looked at Oxfam’s latest research into the rise of Africa’s super-rich and the lack of government commitment to reducing inequality. This week, we dive into the reality of Africa’s tax system and provide some hope for action.

Taxing Africa’s super-rich, in numbers

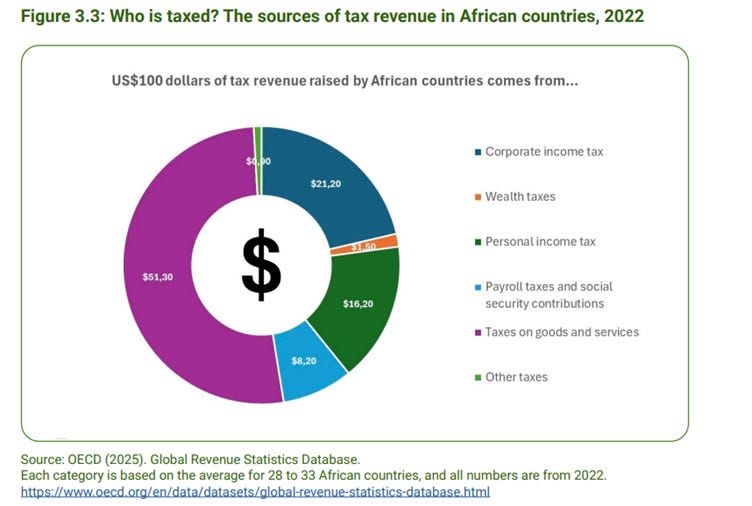

The reality of Africa’s tax. On paper, Africa does particularly well on progressive taxation, with lower value added taxes, higher corporate tax and more progressive income tax rates than global average. However, this strong performance on paper is not translating into actual progressive tax collection, which is well below the global average. African countries collect the lowest amount of tax of any region, at 16% of GDP. In reality, the majority of tax collected is from regressive sources as the table below shows.

Leaking tax coffers. African countries lose, on average, 3.5% of their total tax revenue to multinational corporations’ tax avoidance, which is higher than any other region. Underreporting and tax evasion are widespread among the richest. For example, only one in five dollar-millionaires in Rwanda filed a personal income declaration in 2018 and 99% of Nigeria’s super-rich were found to be non-compliant with their tax obligations. Across 31 African countries,15.2% of their GDP is held offshore.

Plugging the holes. African countries, on average, only have one tax auditor for nearly every 13,000 taxpayers, but could increase their domestic revenue by 1% for every 10% increase in the number of comprehensive audits.

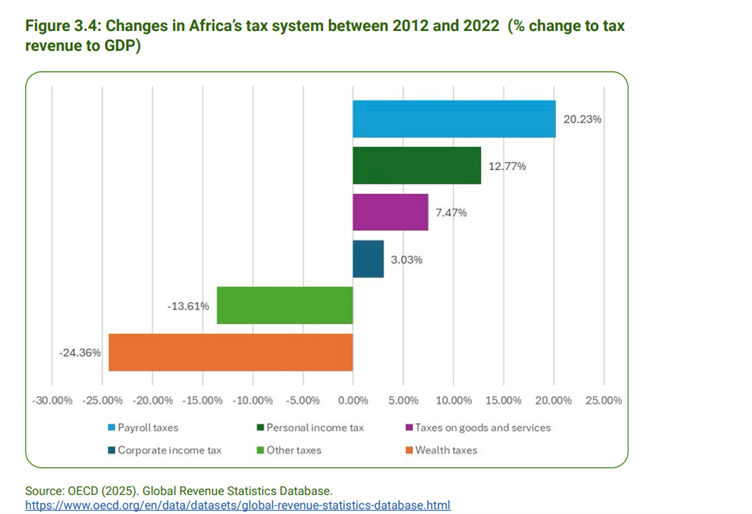

Regressive reality. African countries have increased their reliance on taxes on goods and services and payroll taxes, while taxes on corporate income have barely changed, and collection from wealth taxes has plummeted by nearly a quarter, as the figure below shows.

This reliance on regressive consumption taxes falls on all citizens, but especially on women and people living in poverty, while under-taxing those with the most ability to pay.

Outside influence. The changes seen are not only the result of a lack of government commitment to reduce inequality, but are also the result of outside influence on African countries’ tax policies, not least from the IMF, which has also imposed harmful austerity policies leading to deadly protests in countries such as Kenya and Angola.

Taxing the 1%. Africa’s richest 1% – a group consisting of about 14.7 million people – receive a fifth of all income and own a third of all wealth in the region. The income share of the richest 1% is only reduced by 6.85% on average, which means that Africa’s tax systems are nearly three times less effective at redistributing income away from the richest 1% than the global average.

Revenue potential. African countries could raise nearly US$66bn in additional revenue every year by taxing the richest 1% by an additional percentage point on their wealth and an additional 10 percentage points on their income. This would cover the funding gaps to achieve free quality education and connect all homes and businesses to electricity, with $2 billion to spare.

Widespread public support. 69% of people polled across 34 African countries agreed that it ‘is fair to tax rich people at a higher rate than ordinary people in order to fund government programs to benefit the poor’. A recent poll from 2024 shows that 70% of Kenyans and 68% of South African citizens support a net wealth tax on the rich.

Still hope for a breakthrough on tax. Although the G20 Finance ministers failed to come to an agreement on taxing the rich, despite breakthrough progress in Brazil last year, there is still hope. In a historic breakthrough delivered by African countries, negotiations for a UN Tax Convention, with a terms of reference that recognises the need to tax the rich, began in February 2025. At the International Conference on Financing for Development, a new collaboration to tax the super-rich was launched, involving countries from both the Global South and North, the UN and civil society.

Read Oxfam’s Africa inequality report here for all the details behind these numbers.

Something to read/watch

The Oxfam inequality group chat has been ablaze recently, with loads of interesting articles being shared - so here is some summer/winter holiday reading for you.

Branko Milanovic’s three-part substack series on how in modern capitalist societies, an increasing share of the rich are rich in two dimensions: they are among the best-paid workers, and among the richest capitalists.

Aidan Regan on How the Top 1% of Firms Capture the Profits - a deep, data-driven, dive into how a few US companies capture most profit and market power.

Bhaskar Mitra on Why I am leaving big tech… (because big tech bosses want to drive us towards a techno-fascist future).

Rafael Quintero on The G7’s Corporate Tax Escape Hatch with a wonderful comparison of G7’s global minimum tax reforms as “a new speed-limit rule that applies universally, except for BMWs driven by Americans.”

Ha-Joon Chang on how Economics teaching has become the Aeroflot of ideas (FT paywall)

Kate Pickett on How Equality Will Define Europe’s Next Chapter

Garry Economics puts it succinctly on why billionaires are funding the far right.

I found this article super interesting and what it said about only 4 people are richer than half of Africa's population to be concerning. I also provide some insights in my newsletter, Developmental Insights - if anyone is interested, please check it out.

https://developmentalinsights.substack.com/