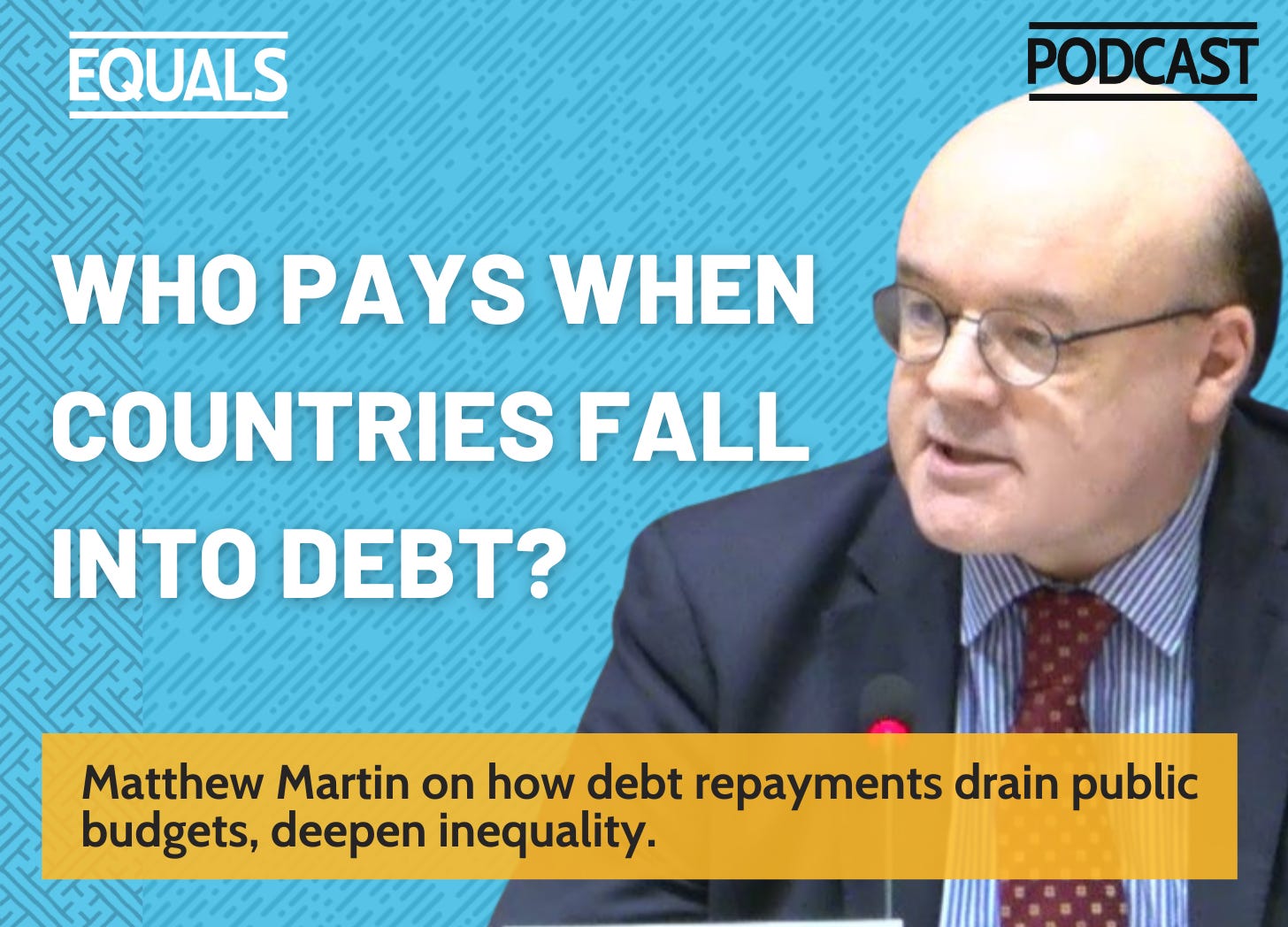

When countries fall into debt, who actually pays the price?

In this episode, we talk to Matthew Martin, a passionate advocate for debt relief and against inequality, who shares his personal journey from experiencing apartheid in South Africa to becoming a leading voice in the fight against global debt crises. Matthew discusses the intricate relationship between debt and inequality, highlighting how high debt burdens disproportionately affect poorer citizens and drive cuts in social spending.

Right now, 5.2 billion people live in countries that spend more money paying back debt than they do on schools, hospitals, or climate action. We break down how that happens, why global financial markets get away with charging eye-watering interest rates, and why governments are so often pushed to cut public services instead of standing up to creditors.

He reflects on the success of the Jubilee debt cancellation campaign and the lessons learned, emphasizing the need for structural change in the global financial system to prevent future crises. With insights into the current state of debt across the globe, Matthew calls for a renewed popular movement to prioritize debt relief and tackle inequality.

If you enjoy the episode, please like, share, comment, and leave us a review. Follow us on X @EQUALShope, Bluesky and on LinkedIn.

Matthew also explores these issues in more depth in a companion blog, unpacking how debt repayments are reshaping public budgets and deepening inequality worldwide. Read it here 👇

Debt Justice to Overcome the Inequality, Climate and Nature Crises

I have been passionate about fighting inequality since I was a child. I grew up in Africa, where the inequality between whites and blacks was shocking – and in some countries the black post-colonial elite were repeating the sins of their former colonial masters.